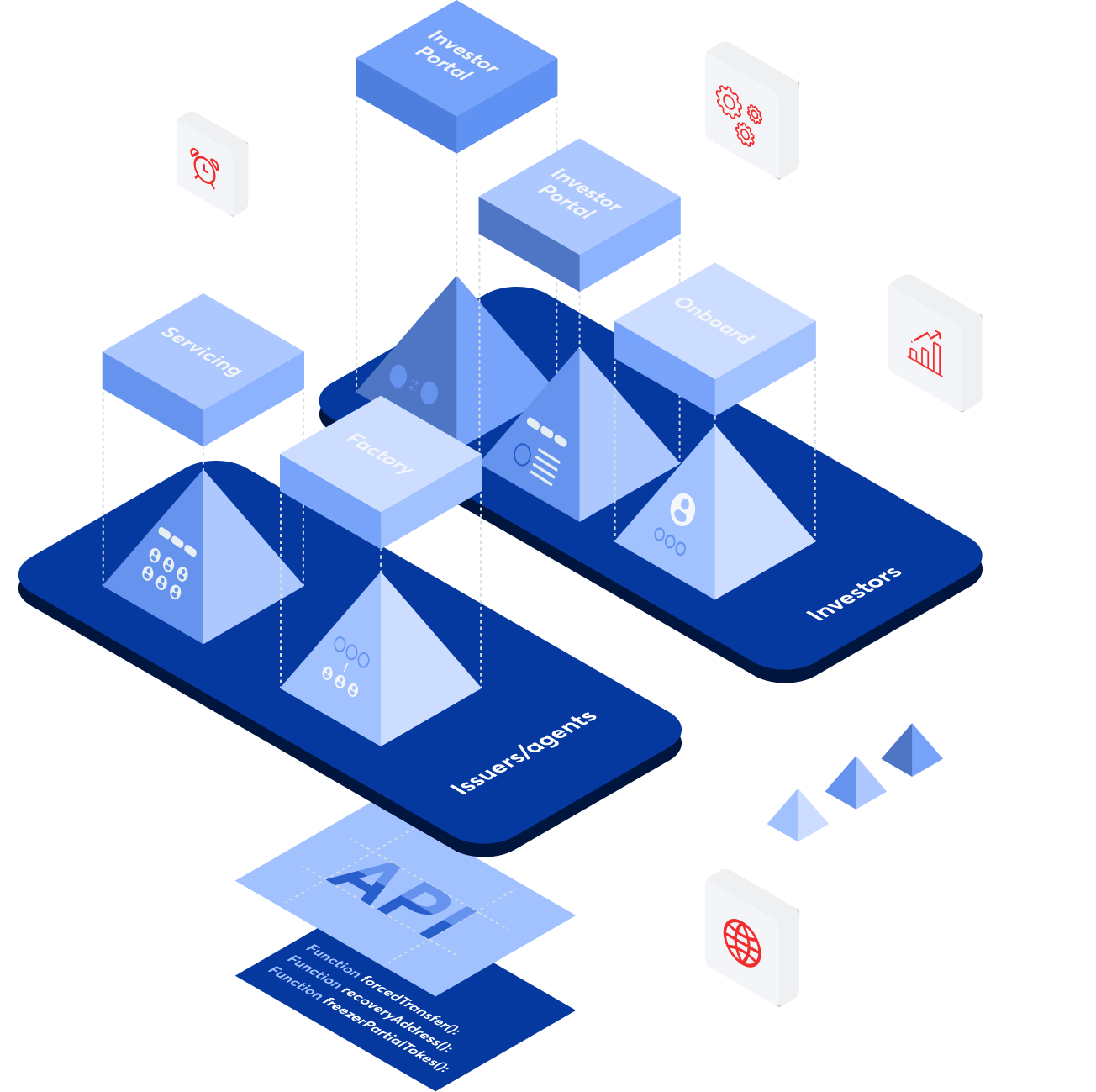

The Cedent Platform provides all components necessary for the set up, issuance and day-to-day management of a tokenized asset. We advise on the tokenization process end-to-end and set your team up with a dashboard where you can sell tokenized shares, facilitate secondary trading, whitelist and manage investors, distribute reports and much more.

Beyond innovative financial services for people and businesses, Cedent is building an open infrastructure that other financial institutions can leverage to start working with the new, decentralized capital markets.

Based on a modular system, our institutional platform is designed to be an open source solution ideal for Fintechs and financial institutions who are interested in digital innovation

A multi-boutique solution to digital asset management

Accredited Digital Asset Custodian, ADAC, is a multi-boutique solution to digital asset management that allows the user to purchase and transact with crypto, manage their digital asset portfolio, and verify their identity and investor status--all from a secure mobile application.

In the “portfolio section,” the user can access security tokens, such as shares, adaptive share tokens, digital mutual funds, bonds and other digital security assets. If a portfolio asset has been issued on the Cedent platform, users are enabled management features, such as shareholder votes, dividends and coupon payments.

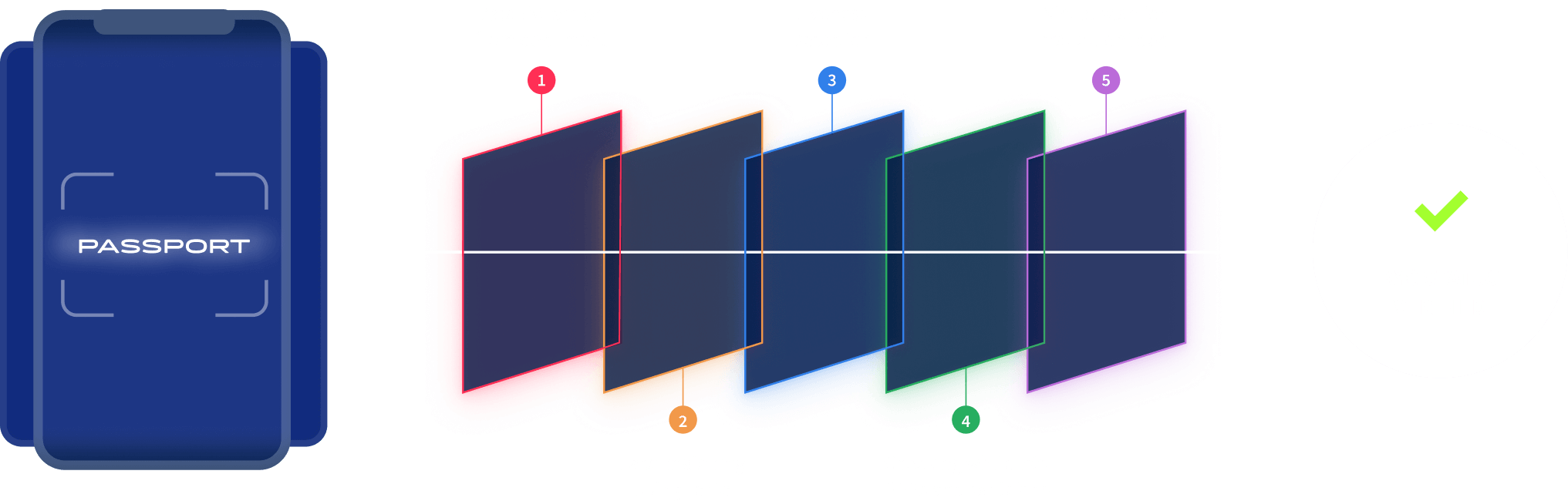

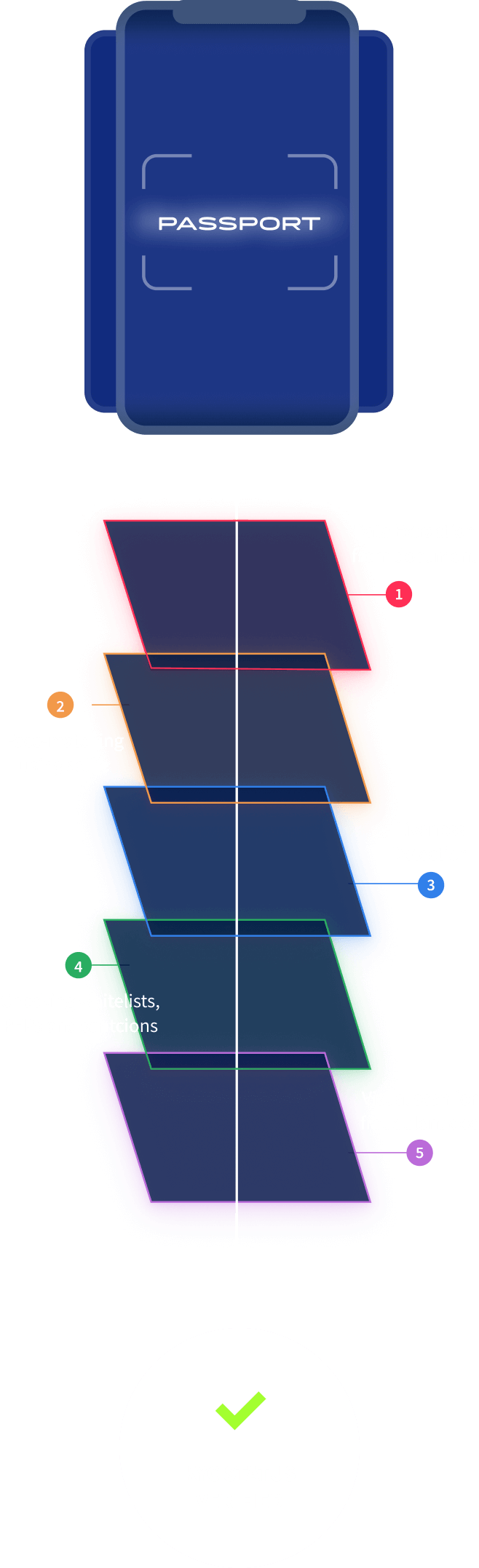

Another essential feature of the ADAC Wallet is the integrated Identity management section, which allows users to verify their identity as well as their investor status. This novel approach to identity management utilizes the blockchain and relational databases to create unique “investor identities.” These identities enable accredited investors and HNIs to verify their status and gain access to institutional-grade investment products.

A blockchain-powered platform which utilizes a syndicate of FSA approved systems to verify the identity and qualification status of investors and entities.

Our identification process has been designed to meet the requirements of

all major KYC/AML directives,

including some of the most stringent in the world.

For each client we onboard, we require a comprehensive compliance process that includes:

Cedent is built on an anticipatory model when it comes to the future of cryptocurrency investment. We believe that with widespread adoption will come regulation. Cedent utilizes ii.Pass’ proprietary system for qualifying investors that utilizes blockchain automation and secure relational databases that meet the FSA requirements for secure data storage.